Behind the Glittering Charts: The Dust of Economic Reality

Published on 26 August 2025

The stock market all over the world had reacted with less enthusiasm except the positive mood in UK and Chinese economy. On the contrary, Japanese stock market showed more vulnerable face of its economy because of the rise in inflation and mounting debt together with debt servicing pressure. In today’s world market react with multifarious factors and It is very difficult to know what is really driving the market. The adage of index becoming the barometer of the economy is losing its prominence. We are living in an age where companies are getting bigger than economies and investment fund companies giving a tough competition to central banks. The nature of fund flow ultimately determines the sentiments in the market. It is really an irony to say that; world is become a mysterious place shrouded in secrecy of data disparity and it is very difficult to know who is possessing the magic wand. At this moment hope for better future and fear of apocalypse is equally driving us . With the advent of Artificial intelligence, the virtual world and real world getting more confused and you require an eye Horus for supreme vision to differentiate reality from virtual reality. It is definitely sure that we are standing at a critical moment on history and the current on-going transformation is potential enough to create entirely new world in the next decade. The most important aspect is that how we are going to address these changes in the world that we live in.

The European region showed more potential signs of recovery. However, the manufacturing PMI in Germany and UK shows contradictory trend. While Germany showed sluggish mood in 2024 but the momentum in picking up in the recent months shows some signs of recovery. On the other hand, for UK the first of half of 2024 showed a better picture and end of the year is witnessed declining trend in UK PMI. The picking of manufacturing momentum in the recent months are considered as marginal in nature when compared with the growth in the first half of 2024. The marginal increase in inflation to 3.8 % for UK is ignorable at this moment even though a slight building up of momentum in visible in the data after the surge of inflation upto 11.1 % in oct 2022, there after inflation showed a declining trend. Likewise, Building permits and housing starts in United states showed contradictory trend, where housing starts showed marginal increase but building permits showed marginal decline. Over all the trend in 2025 showed less momentum in construction sector. Compared with 2021 to 2022 data both the indicator showed a declining trend.

Consistent with the previous trend in 2022 and 2023, Japan economy is more import oriented and dependence on US economy for revival in immensely influencing the policy decision in Japan economy.

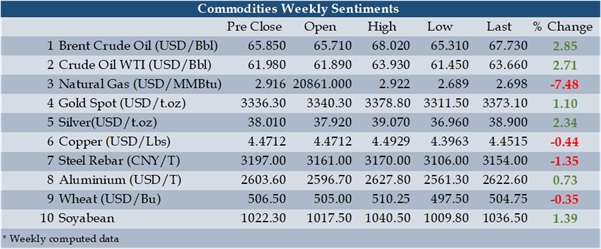

The commodity market showed mixed sentiments where crude oil showed efforts of recovery. The drone attack in Russian refineries had helped the recovery sentiments. The fall in crude oil inventories is critical to promote recovery in prices and the role of OECD countries to control the price mechanism is the major factor to offer some stability in prices. The gold futures continued it rally mood with less enthusiasm on participation as indicated by the drop in volume. The tendency of flat consolidation through sideways movements of prices is more visible from April onwards continued to influence the sentiments in gold prices. The bulls and bears are actively exerting pressure on the commodity which resulted in the flat consolidation of prices. At present the reversal in gold prices in not a predictable outcome since there is no ease for geopolitical tensions all over the world.

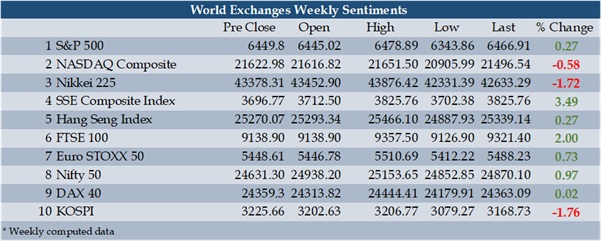

World Stock Markets

Majority of the stock market traded with less enthusiasm spreading the confusion of investors and traders. The stimulus measures especially in the property sector aided the positive sentiments in Chinese stock market and index gained 3.49 percent for the week. The rally in the artificial intelligence stock Deep seek also influenced the sentiments of the investors and ignited the high expectation of the investors for tech and semi-conductor business stocks. The signs of robust recovery of UK economy coupled with peace negotiation with Russia and Ukraine helped the positive sentiments in UK economy. The rally was mainly trigged by banking stocks with support from energy sector stocks amid declining trend in oil prices. The positive sentiments in IT stocks and mid-caps helped the Indian market to stay in the positive zone. However, the over valuation of blue-chip stocks and promising mid-caps are significantly influencing the confidence of Indian investors. The speech of fed reserve chairman Jerome Powell revealed the anxiety over inflation and brooding economic challenges. It is highly expected that in order to address the economic challenges the US government is thinking of cut in interest rate and financial market all over the world reflected to the anticipated economic stimulus measures by the economic giant.

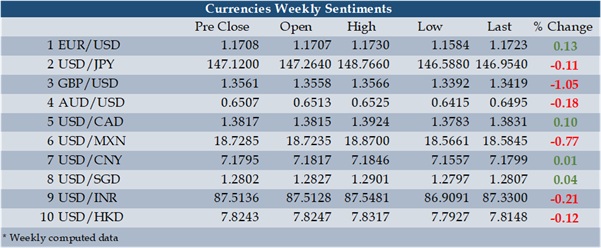

Forex Market

The broad sentiments in the currency market were strengthening of major currencies against US dollar. Pound reacted strongly against US dollar because of the fundamentally strong signs of economic recovery. The anticipation of measures to cut interest rates in US economy also aided in the strengthening of Mexican peso against dollar since Mexico act as an important trading and supply chain partners of United States. Mexico, Canada and China act as the major trading partner for US and near shoring strategy of US companies are offering more edge to Mexican economy. From volatility perspective the currency showed more passive nature reflecting the cautious approach of countries to address impending economic uncertainties.

Commodities market

The commodities market reflected mixed sentiments and the major initiative was the recovery noticed in crude oil. The oversupply and inventory glut had pressurised the copper futures and market reacted with less enthusiasm after the sharp decline in the previous week. The production setback in Chile Codelco miner due to tragic accident at its El Teniente mine had supported the prices from further decline. Natural gas prices cascaded with negative sentiments driven by weak weather demands forecasts together with growing tendency in storage levels. The fall in the crude oil inventories and fears of disruption in global supply mainly due to the Ukrainian drone attacks on key Russian refineries helped the recovery mood in crude oil. Gold futures traded with modest optimism revealing it capacity as safe haven appeal is not eroded but the reduction in trading volume reveal the confusion of investor to participate in the bull run.

Disclaimer

The views are expressed for the purpose of study only and not an advice to any traders or investors in the market. Trading/investing in Financial markets involves considerable risk and you may lose part or all of the initial investment. It is not ideal for all types of investors, and you are advised to seek professional assistance before the same. The news and views posted on this report are based on information, which are believed to be accurate. The author cannot be held responsible for the accuracy of the content posted on this report or for decisions taken by the readers based on such information.