Published on 04 September 2025

When Two Tigers Fight, the Deer Suffers: Emerging Markets Caught Between Major Economic Powers

The nations around the world continued its habit of poking the nose of other nations by pretending that they are doing great service to revive its economy. The interference of US against the crude oil buying by India from Russia and India openness to China for strong bilateral relations remind us the fragility of international relationship. The dangerous trend that is evolving in international trade shows us that, now it is not possible to strive for universal betterment and more probable strategy is to save your foot by nailing others foot. It is really shadowing the ability of international institutions like united nations and others to bring the expected social reforms and contribution to universal goodness. Our generosity and ethics will end when some one really question our superiority complex is really bringing the reminisce of our hunter gatherer instincts. The history of David reminds us that the supremacy of goliath is an image that can uphold until someone with real courage ventures against that supremacy. The report from UNCTAD shows that digital economy and semiconductor industry might be the most promising sector for the next decade. As per the report the global foreign direct investment in digital economy is averaging $122 billion. The contribution of service sector to global economy by drastically surpassing the agricultural and manufacturing sector contributions is really exhibiting that human social needs in the changing world is really setting boundaries of global economy. From that perspective, the digital economy is strong arm of service sector which is going redefine our habits and behaviours.

Saudi Arabia balance of trade statistics in June showed that a revival after the declining trend in the last three months. China and India are major contributors to Saudi Arabia exports. The surge in industrial production of Singapore showed the signs of revival after prolonged sluggishness. The demand for electronics and general manufacturing had set the tempo for industrial production and the volatility in bio medical sector is mainly contributed by robust pharmaceutical output. The increase of foreign direct investment to Brazil as per published July data had really reversed the sluggish trend for the past three months. After five months of sluggishness, the manufacturing sector of Canada showed 1.8 percent rise in manufacturing sector had offered some solace to its economy. The demand in petroleum and coal product really set the trend for manufacturing sector. The durable goods purchase and the trend in real estate sector had not offered any cue for change in trend showing the slow moving of the economy. Narrowing down of turkey trade deficit shows slight improvement of the domestic economy even though the economy is highly import oriented. As per July Data Indian manufacturing production expanded by 3.5 percent after last five months declining trend showing some relief to economy amid the tariff war between India and US getting global attention. The economic data of USA shows that the economy is striving its best to stay with expectations and the bounce back of GDP to 3.3 percent offered some solace to the economy. The initial jobless claims and continuing jobless claims slightly declined without augmenting the economic worries. The Japan economy data not offered surprises by staying within expected range except the down turn in industrial production and retail sales.

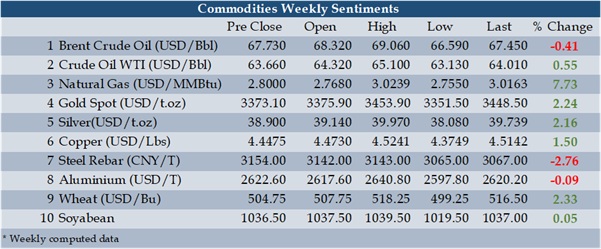

The breakout of gold price after few months of consolidation revealed the worries of global community and their search for safe haven have no other alternative other than gold. The urge of crude oil to stay above 60 dollar per barrel continued to influence the price sentiments and consolidation with more negative bias is still alive in the counter.

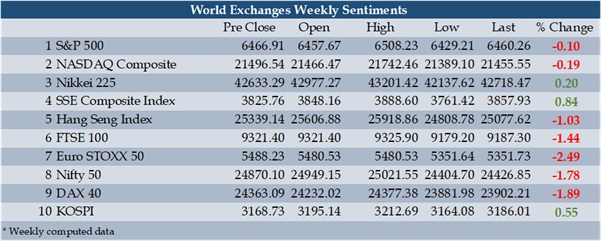

World Stock Market

Major decline noticed in Euro stock market mainly driven by the political instability in French government. The friction between trump government and Fed reserve Lisa Cook also weighted on the sentiments. The Nestle shares plunged due to the surprise removal of nestle CEO over misconduct and this is the second time in this year Nestle is removing its chairman. Less volatility is witnessed in US stock market and uncertainty had drained the enthusiasm of market participants. Japan stock market registered meagre gains since heavy expectation of global investors are neutralized by cautious approach by domestic investors. The expectation for robust performance of EV and semiconductor business largely influences the sentiment of market participants. The seek for stable, predictable and amicable bilateral relation between India and China had soothed the economic worries looming in the region. However Indian stock market failed to regain calmness under such assurance and the cautious approach by investors brought more selling pressure to the market amid the escalating friction in trade relations between US and India. German stock market dwindled due to the expected slow down in GDP. The sector like real estate and utilities are showing weakness augmenting the worries of economic uncertainty. The London stock market also showed weakness mainly due to the bad performance of banking sector stocks.

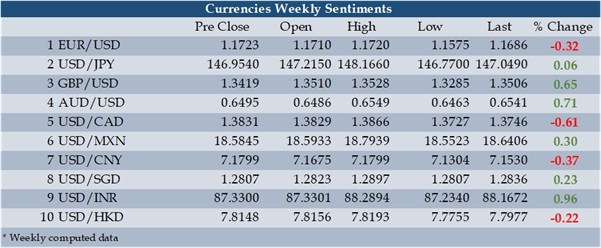

Forex Market

Euro currency showed slight weakness against dollar but the tendency to maintain the flat consolidation is progressing in the charts. The rising government bond yield and weakness of euro region stock market influenced the sentiments in the currency market. Rupee weakened against dollar due to tariff imposed by US on Indian exports coupled with foreign institutional investors outflows. Canadian dollar strengthened against dollar despite the economy showed signs of economic contraction since the manufacturing activity has lessened due to tariff pressure from US. As a commodity currency, Canadian dollar is more supported from the recovery tendency showed in natural gas and crude oil. The Chinese urge to stay ahead against economic headwinds is really helping the market participants to have positive faith in the economy and this tendency is also reflecting in Chinese renminbi strengthening against dollar.

Commodities Market

Natural Gas posted 7.73 percent gain reversing the last five-week negative sentiments since weather forecast pointed to a stronger demand. Gold prices again gained momentum after consolidating from last April onwards because uncertainties increased after escalation of friction of global trade intensified when India started buying crude oil from Russia. The solidarity of BRICS nations to fight against turbulence in global economy had brought more hurdles for US economic efforts to stay with global supremacy. Silver also moved in tandem with gold but gained more strength from strong fundamentals triggered by Chinese solar boom. Weekly gain in wheat futures had nothing to offer to reverse its ongoing bearish hug because ample global harvest and favourable weather weighted on the sentiments. The sluggish sentiments in property and real estate sector helped the bear to have a strong grip over steel futures.

Disclaimer

The views are expressed for the purpose of study only and not an advice to any traders or investors in the market. Trading/investing in Financial markets involves considerable risk and you may lose part or all of the initial investment. It is not ideal for all types of investors, and you are advised to seek professional assistance before the same. The news and views posted on this report are based on information, which are believed to be accurate. The author cannot be held responsible for the accuracy of the content posted on this report or for decisions taken by the readers based on such information.