Published on 10 September 2025

Churning the Economy: Nectar of Growth and Poison of Inflation

In Indian mythology, the churning of the ocean produced both nectar and poison. Similarly, the expansionary phase of an economy generates both growth and inflation. High inflation, in turn, can lead to currency devaluation, and if growth stagnates, it may eventually result in mounting debt. Normally, the time lag between each of these events allows policymakers sufficient opportunity to address them step by step. However, what is unusual in the current global economy is that all these challenges are unfolding simultaneously. And it might not be strange, if it ends in policy paralysis. It is time for global economy to look for some divine intervention rather than implementing policy for survival for the fittest. Whether you win or lose but the war always bleeds. It is time for policy makers ,researchers and economic experts to find a panacea for all economic challenges faced by global economy. It is also the time to come with another enchanting slogan like globalization to motivate the world since the thorns of globalization are visible now.

The manufacturing PMI around the world is showing slight improvement but it is not adequate enough to meet with the expectations. The European region showed more promising nature for the rise in manufacturing output for developed nations. The regions like Spain, Italy and France recorded PMI above 50 showed better position for European region. In Spain, the rise in output and increase in new order supported by strong domestic demand had largely contributed to the PMI. Apart from the European region, Australia showed consistent increase in manufacturing output. The current value at 53 is better than the forecasted value. The Australian government supportive measures especially the grant of $750 million to low emission technologies had produced results. The manufacturing sector in Australia is more focused towards emerging technologies like battery production, green steel and electric vehicles. After the sharp decline in April, May and June , the Indonesian manufacturing PMI shows a gradual improvement to preexisting value before this sharp decline. The shortage of skilled labour and layoff due to structural shift towards modernization and technology upgradation are the issues that need to be addressed by the manufacturing sector in Indonesia which is known for its labour-intensive nature. Interestingly the manufacturing activity in China and India are showing a healthy position amid the worsening of global tariff crisis. China general manufacturing PMI rose to 50.5 in august 2025 and HSBC India manufacturing PMI rose to 59.3 in August 2025.

The first and second sector witnessed significant improvement in capital spending by Japan and current figure at 7.6% shows an acceleration for 6.4 % in the last quarter. The uncertainty in trade tariff had significantly reduced the export prospects of Japan. The initiative for more capital spending at this time is welcome move to address the general sluggishness in economy. The general trend in Korean exports shows a declining mood and current figure at 1.3% is lesser than previous two months figures at 5.8% and 4.3% respectively. The semiconductor business and automobile sector contributes the major pie for Korean exports. Korean exports inconsistent performance with US is a major concern to address while the exports with Asean countries are noticed with significant improvement. A drop in balance of payments for 9.08K USD million in June, 6.61K USD Million July and 6.51 K million in August shows consistent decline even though the data shows an above average performance when comparing with recent past. Korean Imports dropped by 4 percent shows the recent trend of less activity in import. The weakness in data is believed due to the general sluggishness in global electronics coupled with subdued domestic demand.

The Bank of Japan and ECB maintained the current interest rates. As per the industry experts opinion, BOJ might prompt to increase the interest rate in October by 25 basis points to address the inflation and weaker Yen. The bearish trend in majority of commodities is expected to help the economy.

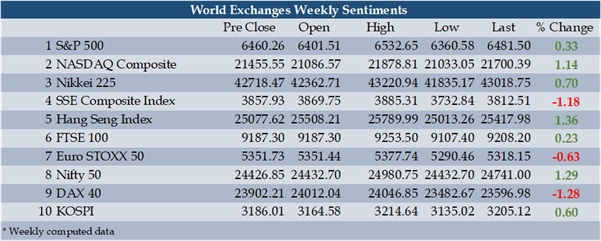

World Stock Markets

Uncertainty loomed over most of markets but interestingly bears showed less aggressiveness due to the lack major cues. Bulls are still running game and they are not worried whether there still fuel to run the show. Even the countries are testing resilient nature of economy without increasing the interest rate. In US stock market, the tech giants captured the momentum and companies like Alphabet, apple and Broadcom impressive profit surge capture the sentiments in the market. Nikkei posted modest gains amid Bank of Japan decision for not changing the interest rate. The market reacted positively to the resignation of prime minister Shigeru Ishiba and the surge in bond yield weakened the Yen and export-oriented sector like captured the momentum for capitalizing the gains in weaker Yen. The shares of Nidec plummeted on improper accounting allegation. Negative sentiments in Chinese stock markets in mainly driven on anticipation of regulations to curb excessive speculation. Meanwhile Unitree robotics a leading Chinese humanoid robotics start up, is preparing for an IPO. The company showed more confidence after the backing of big investors like Alibaba, Tencent and Geely together with an impressive valuation of $ 7 billion. The Hong Kong stock market traded in the positive zone with the impressive performance of giants like Alibaba, Tencent and JD logistics. The Securities and Futures commission (SFC) probe into the insider trading allegations involving personnel from HKEX had promoted the market confidence. London stock market tried to recapture the lost grounds with the support of mining and health care stocks performance. Flat movement noticed in euro index but bear failed to capture more momentum and adequately supported by $50 billion merger between Anglo American and Tech resources. The Indian government decision for GST tax reforms adequately supported the mood in Indian stock market to face the negativity in IT stock over brooding trade relationship with US. Meanwhile Infosys decision to buy back its shares reflected their anxiety over valuation and price sentiments. Mild negativity is noticed in German stock market due to declining industrial orders and rising bond yield. South Korean stock markets showed more apprehensive mood due to labour unrest , trade policy uncertainty and sectorial divergence.

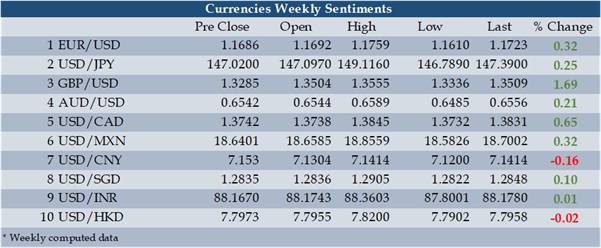

Forex Market

Euro benefitted from broader dollar weakness sentiments and disappointing US job reports aided the sentiments. The major movement in the currency market is the strengthening of pound against dollar. The market was more anxious about imminent fed reserve rate cut. The better economic prospects of Britain made them more promising among G7 countries. The sideways movement of Japanese Yen against dollar was understandable since both countries face significant challenges. The political unrest and rise in bond yield coupled with rising trend in inflation weakened Yen. The comparable better business condition in Australia supported Australian dollar prospects but market failed to reflect more on such sentiments. Even Canadian dollar failed to show significant momentum and similar to US, the job cut in Canada weighted on the sentiments. The government measures to strengthen the Mexican peso by reducing the budget deficit had produced short term visible results and that trend in still alive in the counter even though Peso slightly weakened against dollar for the last week. Instead of the devaluing tendency of yuan, Chinese policy initiatives are helping to strengthen yuan to deescalate the tension with USA. The intervention of RBI had helped rupee from further depreciating in value amid tariff friction with USA.

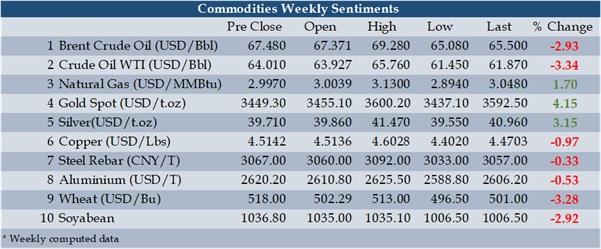

Commodities Market

Apart from precious metal, most of commodities showed bearish sentiments for the week . The modest production hike by OPEC countries together with Russian supply to India and China with good discount had detrimentally affected the oil prices. The sluggish demand for oil continued to strain the prices even though Chinese stock piling of oil continue to add some cushion for market. The expectation of fed reserve rate cut had further strengthened the gold prices which already moving on a bullish path due to geopolitical unrest. The central banks buying together with major inflows towards gold ETF also supported the sentiments. Robust harvest had further weakened the prices of wheat.

Disclaimer

The views are expressed for the purpose of study only and not an advice to any traders or investors in the market. Trading/investing in Financial markets involves considerable risk and you may lose part or all of the initial investment. It is not ideal for all types of investors, and you are advised to seek professional assistance before the same. The news and views posted on this report are based on information, which are believed to be accurate. The author cannot be held responsible for the accuracy of the content posted on this report or for decisions taken by the readers based on such information.